All Categories

Featured

Table of Contents

Pros Access to more investment chances High returns Boosted diversification Disadvantages Risky financial investments High minimum financial investment quantities High performance charges Long resources lock up time The primary advantage of being an approved investor is that it offers you a monetary advantage over others. Since your total assets or salary is already among the greatest, being an accredited investor allows you accessibility to financial investments that others with less wide range do not have accessibility to.

One of the simplest instances of the advantage of being a recognized financier is being able to invest in hedge funds. Hedge funds are largely only accessible to accredited capitalists because they require high minimal investment amounts and can have greater affiliated threats however their returns can be remarkable.

There are also cons to being an accredited investor that associate with the financial investments themselves. A lot of financial investments that require a private to be an accredited capitalist featured high risk. The techniques employed by lots of funds included a higher risk in order to accomplish the objective of defeating the marketplace.

Just depositing a couple of hundred or a couple of thousand bucks right into an investment will not do. Approved financiers will certainly have to dedicate to a few hundred thousand or a couple of million dollars to take part in financial investments suggested for accredited investors. If your financial investment goes southern, this is a great deal of money to lose.

Another disadvantage to being an accredited investor is the ability to access your financial investment capital. If you acquire a couple of stocks online via a digital platform, you can pull that cash out any time you like.

Being a certified financier comes with a lot of illiquidity. They can also ask to review your: Bank and various other account statementsCredit reportW-2 or other revenues statementsTax returnsCredentials provided by the Financial Market Regulatory Authority (FINRA), if any kind of These can assist a company identify both your economic credentials and your refinement as a financier, both of which can impact your condition as a recognized capitalist.

How long does a typical Accredited Investor Real Estate Syndication investment last?

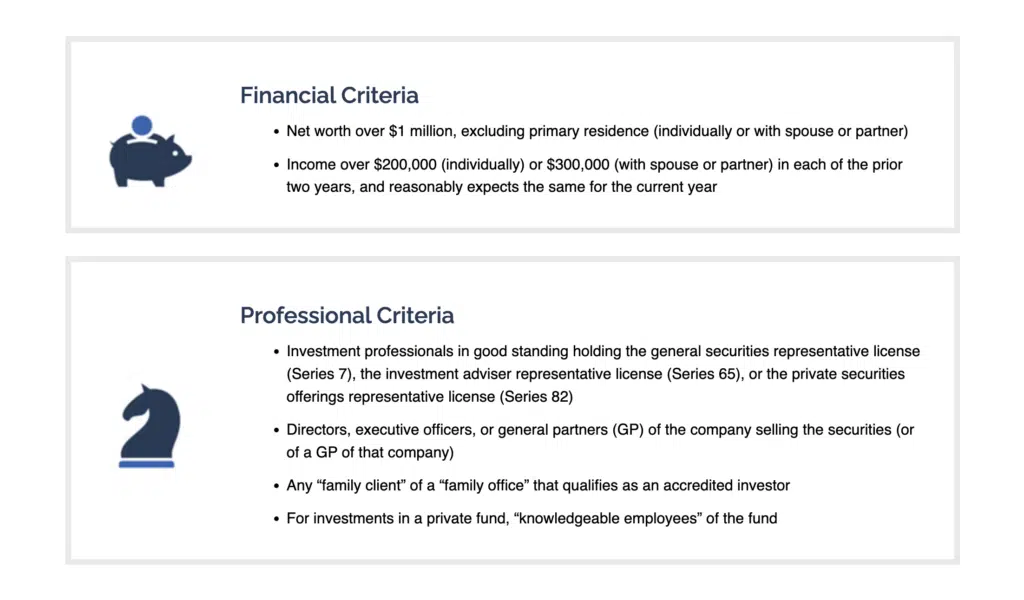

A financial investment car, such as a fund, would certainly have to identify that you qualify as an accredited financier. To do this, they would ask you to fill out a survey and possibly offer specific papers, such as financial declarations, credit scores reports, or income tax return. The benefits of being an approved investor include accessibility to special financial investment opportunities not available to non-accredited investors, high returns, and enhanced diversity in your profile.

In specific areas, non-accredited financiers also deserve to rescission. What this indicates is that if a capitalist chooses they wish to take out their cash early, they can declare they were a non-accredited investor the whole time and receive their cash back. It's never ever a great concept to offer falsified papers, such as phony tax returns or monetary statements to a financial investment lorry simply to spend, and this might bring lawful trouble for you down the line.

That being said, each deal or each fund might have its very own constraints and caps on financial investment amounts that they will certainly accept from a financier. Approved capitalists are those that fulfill particular needs relating to income, certifications, or web worth.

When you end up being a certified financier, you remain in the elite team of individuals who have the economic ways and regulatory clearance to make financial investments that can not. This can imply exclusive access to hedge funds, financial backing firms, certain investment funds, personal equity funds, and extra. The Securities and Exchange Commission suggests by coming to be an approved financier, you possess a degree of refinement qualified of constructing a riskier financial investment profile than a non-accredited investor.

It's additionally concentrated on a really particular niche: grocery-anchored business property (Real Estate Investment Partnerships for Accredited Investors). FNRP's group leverages relationships with top-tier national-brand tenantsincluding Kroger, Walmart, and Whole Foodsto give financiers with access to institutional-quality CRE deals both on- and off-market. Unlike a lot of the various other sites on this list, which are equity crowdfunding systems, FNRP uses exclusive placements that only a recognized financier can accessibility

What should I look for in a Real Estate Investment Partnerships For Accredited Investors opportunity?

about the chance and figure out whether it makes good sense for your investment goals. Check out a lot more in our. Yieldstreet $2,500 All Investors basically, any type of property that falls beyond supplies, bonds or cashhave become progressively prominent as fintech solutions open previously shut markets to the specific retail capitalist. These possibilities have actually democratized many markets and opened formerly hard to reach money flows to pad your earnings.

You need to be a recognized investor to participate in all other Yieldstreet offerings. Find out more, and take into consideration accessing these passive income financial investments, by today. EquityMultiple $5,000 Accredited Investors Only Some property crowdfunding platforms just permit you to purchase residential property profiles. Some systems, such as, likewise enable you to invest in private propertiesin this instance, business genuine estate (CRE).

Nevertheless, those investors have accessibility to private industrial property bargains, funds, and also varied short-term notes. Specifically, EquityMultiple only permits its individual business realty projects to get investments from accredited investors. For those curious about learning even more regarding, think about enrolling in an account and going through their certification procedure.

Latest Posts

How To Find Tax Foreclosure Properties

Land For Sale For Back Taxes

Tax Overage Business