All Categories

Featured

Table of Contents

Choosing to buy the genuine estate market, stocks, or various other basic sorts of assets is prudent. When deciding whether you need to purchase certified financier possibilities, you should stabilize the trade-off you make between higher-reward prospective with the absence of coverage requirements or regulatory transparency. It needs to be claimed that exclusive positionings require greater levels of threat and can on a regular basis represent illiquid investments.

Particularly, nothing below needs to be translated to state or indicate that previous results are an indicator of future performance nor need to it be analyzed that FINRA, the SEC or any various other securities regulator authorizes of any one of these safeties. Additionally, when examining private positionings from sponsors or firms offering them to accredited financiers, they can provide no guarantees expressed or implied regarding precision, efficiency, or results acquired from any type of details offered in their conversations or discussions.

The business must provide details to you via a document called the Personal Placement Memorandum (PPM) that uses a much more comprehensive description of costs and threats associated with joining the financial investment. Interests in these offers are just provided to individuals who qualify as Accredited Investors under the Stocks Act, and a as defined in Area 2(a)( 51 )(A) under the Company Act or an eligible worker of the monitoring firm.

There will not be any public market for the Interests.

Back in the 1990s and early 2000s, hedge funds were known for their market-beating efficiencies. Usually, the supervisor of an investment fund will certainly set apart a part of their available assets for a hedged wager.

What types of Accredited Investor Real Estate Syndication investments are available?

For instance, a fund supervisor for an intermittent industry might commit a part of the possessions to stocks in a non-cyclical field to offset the losses in instance the economic climate tanks. Some hedge fund managers utilize riskier strategies like making use of obtained money to acquire even more of an asset simply to multiply their possible returns.

Similar to shared funds, hedge funds are professionally taken care of by job investors. Hedge funds can use to various investments like shorts, options, and derivatives - Accredited Investor Commercial Real Estate Deals.

What is included in Passive Real Estate Income For Accredited Investors coverage?

You may select one whose financial investment ideology aligns with yours. Do remember that these hedge fund money managers do not come economical. Hedge funds normally bill a charge of 1% to 2% of the possessions, along with 20% of the profits which works as a "performance fee".

High-yield investments draw in many financiers for their capital. You can buy a property and obtain compensated for holding onto it. Approved capitalists have much more chances than retail capitalists with high-yield financial investments and past. A better variety offers certified investors the possibility to get higher returns than retail capitalists. Certified capitalists are not your common financiers.

Accredited Investor Real Estate Investment Groups

You need to meet at least one of the complying with criteria to come to be an accredited investor: You have to have more than $1 million internet well worth, omitting your primary house. Organization entities count as certified financiers if they have more than $5 million in possessions under monitoring. You have to have an annual earnings that exceeds $200,000/ yr ($300,000/ yr for partners submitting with each other) You have to be an authorized investment expert or broker.

As a result, approved capitalists have much more experience and money to spread out across possessions. Many financiers underperform the market, including recognized investors.

In addition, capitalists can develop equity with positive cash money circulation and residential property recognition. Real estate buildings need considerable maintenance, and a lot can go incorrect if you do not have the appropriate team.

High-yield Real Estate Investments For Accredited Investors

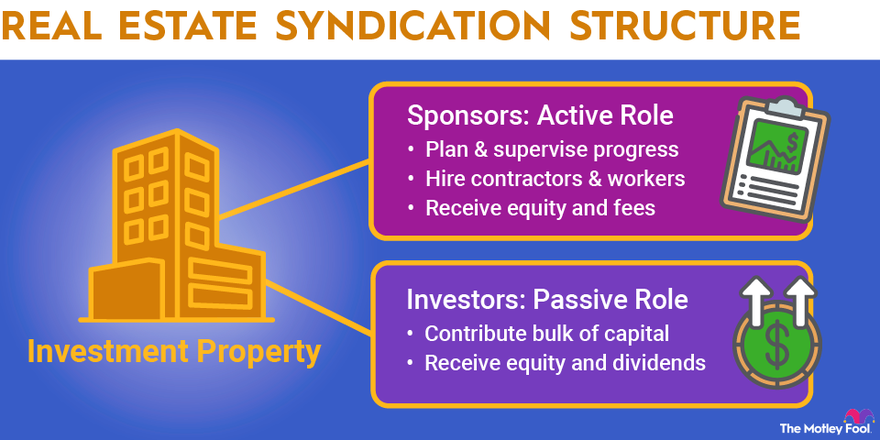

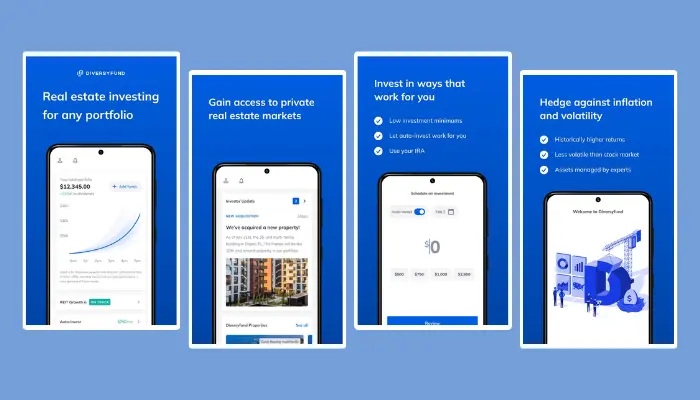

The enroller finds investment chances and has a group in position to take care of every responsibility for the property. Realty distributes merge cash from accredited financiers to buy properties straightened with well established purposes. Personal equity realty allows you buy a team of residential or commercial properties. Accredited capitalists merge their cash with each other to fund acquisitions and property development.

Realty investment depends on must distribute 90% of their taxable earnings to investors as dividends. You can purchase and offer REITs on the stock exchange, making them extra fluid than many financial investments. REITs enable investors to branch out promptly throughout several residential property courses with very little capital. While REITs likewise turn you into an easy financier, you obtain more control over essential choices if you sign up with a property organization.

How do I apply for Accredited Investor Real Estate Partnerships?

The owner can determine to execute the exchangeable alternative or to market before the conversion happens. Exchangeable bonds enable financiers to purchase bonds that can come to be stocks in the future. Financiers will benefit if the stock cost rises given that exchangeable financial investments offer them more attractive entry points. If the stock rolls, investors can decide against the conversion and protect their funds.

Latest Posts

How To Find Tax Foreclosure Properties

Land For Sale For Back Taxes

Tax Overage Business